What the OpenAI Saga Reveals About Double Standards for Diverse Founders

Nicol Turner Lee / Dec 1, 2023

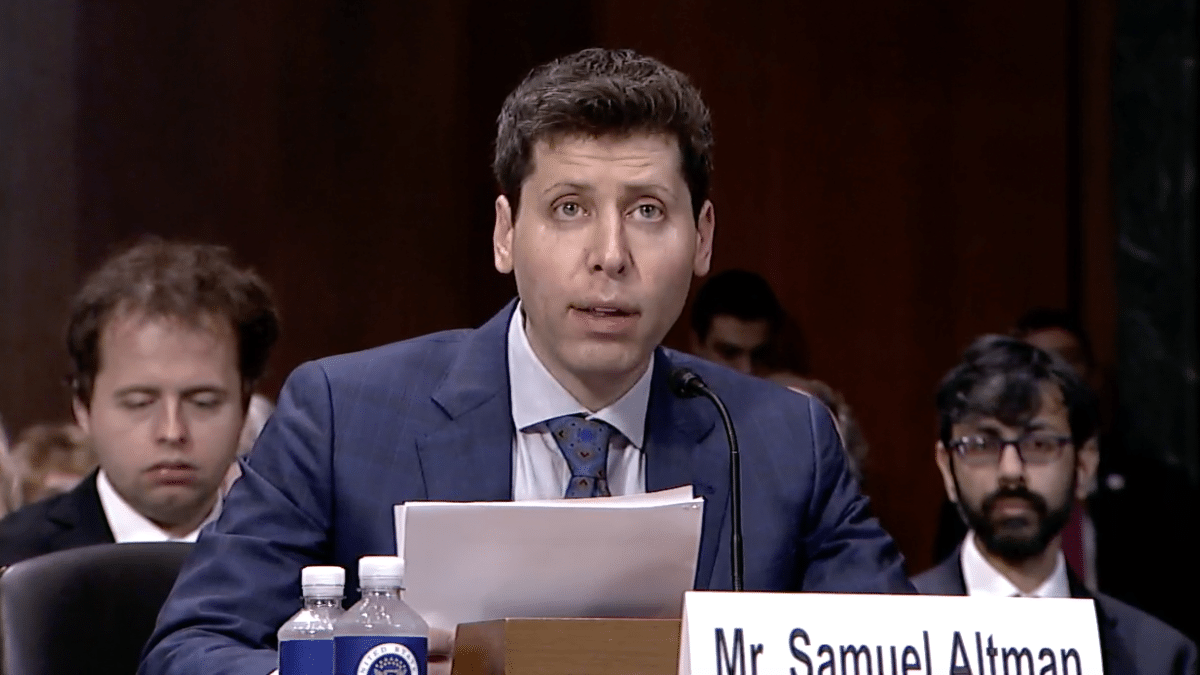

OpenAI CEO Sam Altman testifies before a Senate subcommittee on May 16, 2023.

The firing and subsequent reinstatement of Sam Altman as OpenAI’s leader turned out to be not so bad for the organization, or for him. Altman returned as CEO, with a new Board. Despite his very public firing, Altman also secured the ongoing trust of OpenAI’s largest investor, Microsoft, which just joined the Board as a non-voting member.

While much of the commentary on the drama at OpenAI has focused on tensions in its governance structure, few have acknowledged that OpenAI’s more-than-generous funding by venture capitalists (VCs) likely buffered the consequences for Altman and his team and made it possible for him to emerge unscathed in the end. The situation reveals the double standards in VC funding that exist for diverse tech founders, especially people of color and women, who face scrutiny at all stages of capital development and would not have survived a public termination. Reading between the lines, the OpenAI saga substantiates the ongoing claims that VCs still maintain steady confidence in founders that represent the status quo, who are usually white and male, and are slow to fund and perhaps save startups led by people of color and women.

OpenAI started with high-profile support at its inception in 2015 as a nonprofit organization. Tech luminaries, including Elon Musk, Peter Thiel, and Reid Hoffman, helped the organization raise about $130 million in 2019. Back then, the company recruited some of the best minds in AI and transitioned from a nonprofit to a “capped profit” organization to encourage additional investment. A year later, the company announced the Generative Pre-Trained Transformer 3 (GPT-3), the large language model that formed the basis of the chatbot ChatGPT. That product’s success led Microsoft, already an OpenAI backer, to more than double its investment in 2023. Earlier this year, Microsoft announced a multi-year, $10 billion commitment to OpenAI’s for-profit arm. When Altman was initially fired last week, the company had 770 employees and a valuation estimated at $80 billion, a number which will most likely increase.

However, Altman’s Cinderella-ending is much better than the one often experienced by startups founded and led by diverse founders. That is because diverse founders are still at the bottom of the barrel when it comes to the interest of some VCs. In a June 2023 report, McKinsey reported that Black and Latino founders received only 1 to 1.5 percent of total US venture capital funding. Women received 1.9 percent of VC funds, and Black and Latino women received only 0.1 percent. The report pointed out that despite diverse founders outperforming white counterparts upon exit at more than 30 percent, they continue to be overlooked by prominent VCs for reasons that include the lack of affinity with the investors’ expectations in ideas or backgrounds; the differences in the race, ethnicity, or gender of the founder and investor; and the absence of other white men as cofounders. On this last point, many Black founders were encouraged to bring on straight white men as leaders to increase their funding prospects.

These recent findings highlight the systemic and individual investor biases restricting the opportunities of non-white and non-male founders. Among Black women startups, they receive the least amount of available funding among all groups and are severely handicapped by the perception of their inability to lead innovative companies when compared to other founders. Diverse founders also tend to be held to higher-than-normal standards to get into the door or raise capital for their enterprises.

California is working to change this trajectory through a new law that requires VC firms to disclose diversity data about their investments. Starting in 2025, VC firms will undergo an annual survey about the companies in their portfolios, reporting data on the race, ethnicity, disability status, and gender identity of the founders they back. If investors are noncompliant, there will be fines. While transparency will be a significant step in revealing gaps, the law is state-specific and may not uncover some of the explicit and implicit investor biases.

Kapor Capital, a VC firm also located in California, is finding new ways to invest in more diverse founders. According to its web site, 34 percent of the firm’s first-time investments have gone to racially under-represented founders, and 38 percent to woman-identifying ones. The fund also targets startups that make returns in community assets, including jobs for low-income people and other wealth-enhancing programs. According to a 2022 report by ProjectDiane, a project of the nonprofit digitalundivided, Black female founders made breakthroughs with more than 350 Black female entrepreneurs who raised $1 million or more for their ventures, and another 100 of these founders reaching $10 million or more. But recent attempts to attack efforts that preserve affirmative action could reverse such progress. Conservative groups, like America First Legal, have been busy attacking programs that support Black women founders.

As OpenAI’s internal dealings have made public headlines, Sam Altman and his 700 plus employees are back to work, and under a governance structure that will advantage his ability to raise additional funding and expand his networks. But the days of drama at the company should also serve as a reminder that not all founders and funding resources are treated equally in the tech sector, and this is another glaring example of the seemingly comfortable bets that tech investors make on white men even during the most tumultuous times.

Authors